Business support hub

What are you looking for today?

Filter by

Accounts

Agriculture

Audit / assurance

Business recovery

Construction / Property

Charities / NFP

Cloud accounting

Corporate finance

Hospitality / Leisure

Payroll

Personal debt

Tax services

Wealth management

TC blog

TC news

What is the Growth Guarantee Scheme?

The Growth Guarantee Scheme (successor to the Recovery Loan Scheme) hopes to support around 11,000 smaller businesses over the next 21 months until March 2026. The British Business Bank will administer the scheme on behalf of the Secretary of State for Business and Trade, providing lenders with a 70% government-backed guarantee.

Window on Wealth Summer 2024

Welcome to the latest edition of our Window on Wealth Summer 2024 wealth management newsletter. This edition is packed with articles covering many of the key wealth management challenges and questions currently facing savers and investors.

How to budget for entertaining (and avoid a tax penalty)

Be budget aware and don’t entertain a tax penalty when it comes to entertaining clients or rewarding staff. Your budget might not stretch to a ticket to the Euros or a trip to the Olympics but whatever you choose, allowable deductions could make your budget go further.

Journal Entry Summer 2024

Welcome to the latest edition of our business newsletter Journal Entry. Our ‘Euros’ themed articles range from teamwork in business, to the tax implications of working overseas and allowable deductions for tax purposes when it comes to entertaining.

Property & Landlord Hub

Welcome to our new Property and Landlord Hub. Here you will find news, updates, FAQs and advice on property and landlord issues.

How to master business expenses

Learning how to master business expenses is an important part of making a company as tax efficient as possible. Having a practical approach to expense management, by incorporating relevant apps and software, allows for streamlined, accurate and efficient tracking.

Scots AUTOSCENE magazine – Business Funding

In the latest edition of the re-branded SMTA magazine Scots AUTOSCENE (formerly Auto Insight), we pair up with the team at Breadalbane to discuss various business funding options for company owners.

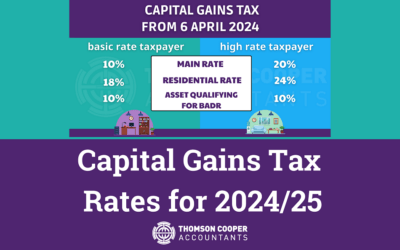

Capital Gains Tax Rates for 2024/25

Capital Gains Tax (CGT) is raises billions for the UK Government every year. Here we look at the some of the key aspects of CGT and the current rates applied to both basic and high rate taxpayers.

How to reduce your Inheritance Tax liability

Understanding the implications of Inheritance Tax (IHT) is essential for effective estate planning. With careful preparation, you can ensure your beneficiaries receive their maximum inheritance while minimising any tax due.

Downloadable guides

Funding update - furlough payments, 5th SEISS grant and BBLS re-payment options

July 14, 2021

The 'Go Local' Initiative - bringing more healthy local produce to convenience stores in Scotland.

June 29, 2021

Scotland Coach Operators COVID-19 Business Support and Continuity Fund - Strand Two

June 21, 2021

Unlocking Ambition - business growth and leadership programme in search for new applicants

June 16, 2021

Culture Organisations and Venues Recovery Fund / Performing Arts Venues Relief Fund - round 2

June 15, 2021