Making Tax Digital for Income Tax Self Assessment (MTD ITSA)

Following on from our summer update about Making Tax Digital for VAT (MTD) we are now just 18 months away from the first landing of MTD ITSA. This short article will focus on what we know about how it will work.

What is MTD ITSA?

MTD ITSA is the next phase of HMRC’s road map and focuses on Income Tax Self Assessment. MTD ITSA will replace the way earnings are reported to HMRC meaning the traditional annual Self Assessment tax return will cease to exist.

Who will it effect?

The first landing of MTD ITSA will affect sole traders and landlords with a combined turnover over £10,000. This will come into effect from April 2024 but like MTD VAT it is advantageous to get your house in order before the deadline comes into effect and MTD ITSA becomes mandatory. If you don’t already have MTD compliant software you want to start looking at compliant solutions and begin processing your next financial year to ensure you feel confident before ITSA becomes mandatory.

How will it work?

MTD ITSA will replace the way in which earnings are reported to HMRC but how will it work?

Instead of one annual submission there will be at least six.

The six submissions will consist of the following:

- 4 quarterly submissions – for each business

- 1 annual End of Period Statement – for each business

- 1 annual Final Declaration – for the individual

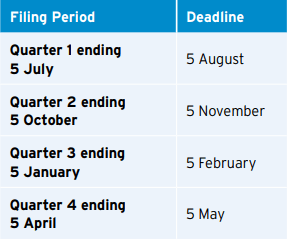

The filing date for the quarterly submission are listed below:

The End of Period Statement is essentially an individual tax return for each business. This is where accounting adjustments and reliefs can be claimed if they have not been adjusted during the year. The End of Period Statement is made up to the 5 April and is due for filling the following 31 January.

Similarly the Final Declaration consolidates all forms of income into one submission which again is due the following 31 January.

On submission of a quarterly return, the taxpayer will receive back from HMRC an estimate of their tax liability. This will be reported within the taxpayer’s MTD software.

There are still a number of areas relating to MTD ITSA to be clarified by HMRC. We will update our clients as we learn more but if you would like to know more about suitable software solutions or how our specialist outsourcing department can help with your accounting admin, please get in touch.

Contact Elaine Cromwell – ecromwell@thomsoncooper.com