Although R&D credits are a valuable resource for your company, they do require some specific accounting processes. Here’s how you should go about it.

Tax services articles

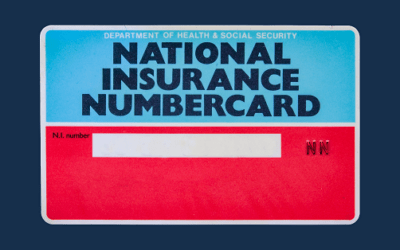

How do changes to NICs affect you when you’re self -employed?

This article explains how National Insurance contributions thresholds have changed for self-employed people, and what this means in terms of when and how much should now be paid.

Can I reduce my tax bill?

Employees, self-employed or owners of limited companies; landlords and investors, here are some ideas to help reduce your tax bill and make the most of the schemes and allowances on offer.

The end of the road: ready to exit your business?

How to extract your hard-earned cash in a tax efficient way when considering retirement plans or an exit strategy.

How to reduce corporation tax

The key to reducing your corporation tax is to know the rules of the tax system and plan accordingly.

Know Your Personal Tax Position in 2022

The impact of COVID-19, Brexit, global supply chain issues, energy price increases and inflation mean that personal finances are under strain like never before. Here is an overview of the key personal taxes and tax changes you need to know in 2022/23 so you can plan accordingly.